Importance of Enterprise Risk Management in Organisations and Careers – a webinar by India Affiliate of Institute of Risk Management (UK)

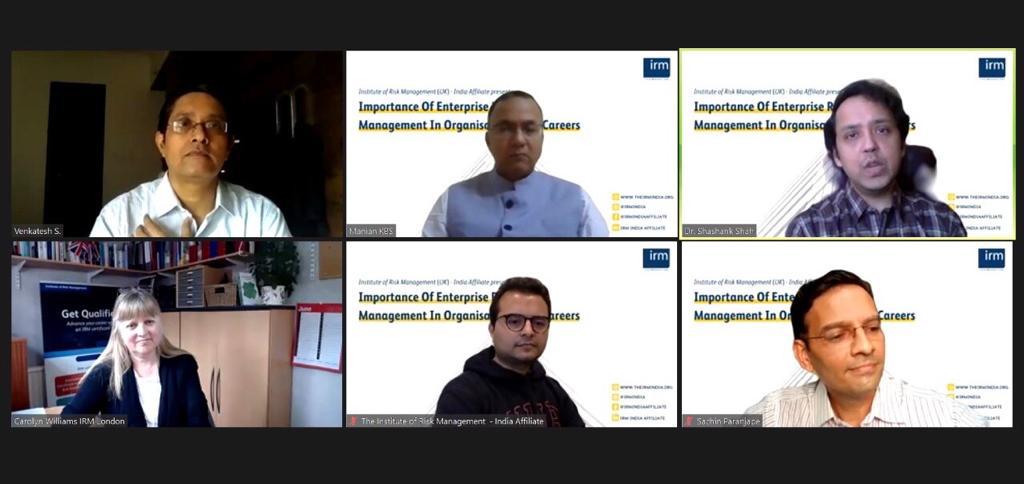

Mumbai: India Affiliate of Institute of Risk Management – UK (IRM India), a global professional body offering qualifications in Enterprise Risk Management, today conducted a panel discussion via webinar on the Importance of Enterprise Risk Management in Organisations and Careers. The panelists included members of the Strategic Advisory Board of IRM India, including Dr. Shashank Shah, Fellow’17, Harvard University; KBS Manian, Group Chief Risk Officer & Head of IA, Apollo Hospital; Venkatesh S, Head, Risk and Internal Control, Siemens Limited; Carolyn Williams, Director, Corporate Relations, IRM London; and Sachin Paranjape, Leader Strategic Risk Practice, India & Corporate Governance Service, Asia Pacific, Deloitte, who moderated the discussion.

While the discussion covered a range of topics, the key focus was on the panelists’ journey in the risk management domain, key skills to be mastered by risk professionals, future of risk management as a career, IRM’s Qualifications as a pathway towards a Chief Risk Officer and how companies need to build resilience with a serious investment in risk culture.

“If you consider the top 100 economies of the world, 70 of them are companies while only 30 are countries – this demonstrates the need to focus on enterprise risk management (ERM) in today’s VUCA world. Risk is critical to all entrepreneurial ventures. But there is a need to move from a purely compliance-based approach to risk that is limited to certain silos and primarily focuses on preventable risks, to ERM that helps in managing strategic risks, and anticipating and minimising the impact of external risks. The key skill for a successful enterprise risk manager would be the ability to see the big picture, connect the dots and reduce the negative impact not only on the profitability of the company but on a larger set of stakeholders including people, society and the environment”, noted Dr. Shashank Shah, Fellow’17, Harvard University.

Sachin Paranjape, Leader Strategic Risk Practice, India & Corporate Governance Service, Asia Pacific, Deloitte, concurred with this, adding, “Risk intelligence is key to a risk manager’s role because there are risks associated even with not taking risks. The CRO, therefore, plays a critical role in helping the CEO develop healthy risk-taking behaviour, and in providing guidance not just on avoiding certain risks, but also on making Risk Informed decisions”.

KBS Manian, Group Chief Officer & Head of IA, Apollo Hospitals, also agreed with the two panellists, saying, “Risk managers need to be enablers rather than masters of everything. CROs can play an important role by facilitating their leadership team in structuring their risk management. More than auditors, they need to be advisors, and must develop collegial relationships across all departments and functions, for greater trust and collaboration in achieving the organization’s objectives”.

Carolyn Williams, Director, Corporate Relations, IRM London, further noted, “The world can change at any time, and so people and organisations need to keep reinventing themselves. All personnel across an organization need to have the ability to understand risk and interpret emerging trends from a risk perspective. The role of a CRO, therefore, is to ensure risk proficiency and management across the organization for better decision making.”

The panel also discussed the impact of the changing business environment on start-ups, emphasising the need for entrepreneurs to create a better value proposition for their investors by demonstrating a focus on risk management right from the organisation’s inception.

Speaking about the webinar, Hersh Shah, CEO, India Affiliate of Institute of Risk Management (UK) said, “The present times have truly highlighted the importance of risk thinking as a critical underpinning of business strategy. We are grateful to the esteemed members of our Strategic Advisory Board in India, for facilitating this vital and much-needed discussion. The diverse perspectives and vast collective expertise of the panellists gave deep insights into specific elements of enterprise risk management, that benefited our audience. It was very inspiring for us, to see participation from people from across India as well as UK, USA and the Middle-East, who demonstrated great enthusiasm and curiosity for the subject with their thought-provoking questions. Being the leader for enterprise risk management qualifications and research since the last 30 years across 143 countries, IRM India is committed to developing a community of risk-thinking leaders, and we hope to organize more such informative sessions.”

India Affiliate of Institute of Risk Management (UK) was formed out of the organisation’s desire to fast-track risk management capability in India, given the dynamic nature of the nation and its economy, and its vital position in a rapidly-evolving world. The organisation offers 5-level qualification, with designations and global professional standards, to working professionals at all hierarchical levels, as well as anyone who has completed 12th Grade. Individuals enrolling for the qualifications become part of a global community spanning 143 countries, with access to online resources, thought leaders, topical webinars, and special interest groups.