Abundant Coal Supply in Domestic Market Results in Declining Coal Price Index

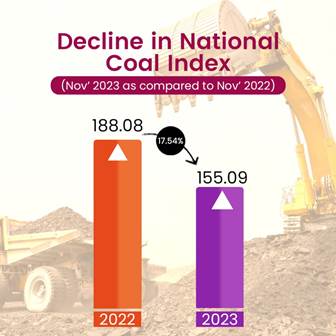

The National Coal Index (NCI) is a price index that combines coal prices from all sales channels, including Notified Prices, Auction Prices, and Import Prices. Established with the base year as fiscal year 2017-18, it serves as a reliable indicator of market dynamics, providing valuable insights into price fluctuations. The National Coal Index has shown a significant decline of 17.54 % in November 2023 at 155.09 points compared to November 2022, where it was at 188.08 points, which indicates a strong supply of coal in market, with sufficient availability to meet the growing demands.

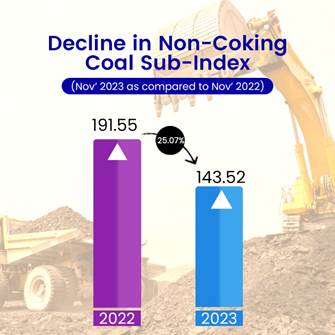

Similarly, the NCI for Non-Coking Coal stands at 143.52 points in November 2023, reflecting a decline of 25.07 % compared to November 2022, while Coking Coal stands at 188.39 points in November 2023, with a growth of 5.79% compared to corresponding period of last year. The peak of NCI was observed in June 2022 when the index reached 238.83 points, but subsequent months have experienced a decline, indicative of abundant coal in the Indian market.

Additionally, the premium on coal auctions indicates the pulse of the industry, and the sharp decline in coal auction premium confirms the sufficient coal availability in the market. India’s coal industry affirms a substantial stockpile, with coal companies holding impressive Stock. This availability ensures a stable supply for various sectors dependent on coal, significantly contributing to the overall energy security of the nation.

The downward trend in the NCI signifies a more balanced market, aligning supply and demand. With sufficient coal availability, the nation can not only meet the growing demands but also support its long-term energy requirements, thus building a more resilient and sustainable coal industry and securing a prosperous future for the nation.