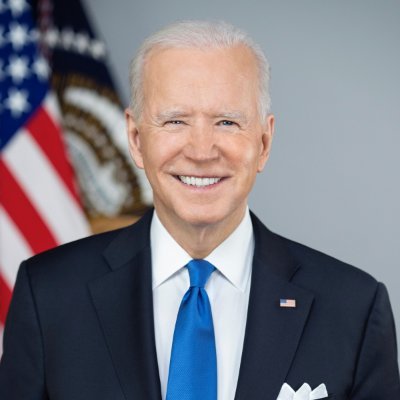

Biden-Harris Administration Announces an Additional $9 Billion in Student Debt Relief

The Biden-Harris administration announced today that an additional 125,000 Americans have been approved for $9 billion in debt relief through fixes the U.S. Department of Education has made to income-driven repayment (IDR) and Public Service Loan Forgiveness (PSLF), and granting automatic relief for borrowers with total and permanent disabilities. Today’s announcement brings the total approved debt cancellation by the Biden-Harris Administration to $127 billion for nearly 3.6 million Americans.

The Biden-Harris Administration is announcing it has approved:

- $5.2 billion in additional debt relief for 53,000 borrowers under Public Service Loan Forgiveness programs.

- Nearly $2.8 billion in new debt relief for nearly 51,000 borrowers through fixes to income-driven repayment plans. These are borrowers who have been in repayment for 20 or more years but never got the relief they were entitled to

- $1.2 billion for nearly 22,000 borrowers who have a total or permanent disability and have been identified and approved for discharge through a data match with the Social Security Administration.

“For years, millions of eligible borrowers were unable to access the student debt relief they qualified for, but that’s all changed thanks to President Biden and this Administration’s relentless efforts to fix the broken student loan system,” said U.S. Secretary of Education Miguel Cardona. “The Biden-Harris administration’s laser-like focus on reducing red tape, addressing past administrative failures, and putting borrowers first have now resulted in a historic $127 billion in debt relief approved for nearly 3.6 million borrowers. Today’s announcement builds on everything our administration has already done to protect students from unaffordable debt, make repayment more affordable, and ensure that investments in higher education pay off for students and working families.”

The Biden-Harris administration has taken historic steps to reduce the burden of student debt and ensure that student loans are not a barrier to opportunity for students and families. The Administration earlier this year launched the most affordable student loan repayment plan – SAVE – which makes many borrowers’ monthly payments as low as $0 and prevents balances from growing because of unpaid interest. The Administration secured the largest increase to Pell Grants in a decade, and finalized new rules to protect borrowers from career programs that leave graduates with unaffordable debts or insufficient earnings. And, in the wake of the Supreme Court decision on the Administration’s original student debt relief plan, President Biden announced his Administration was pursuing an alternative path to debt relief through negotiated rulemaking under the Higher Education Act.

The Department of Education took an important step forward in the negotiated rulemaking last week – announcing individuals who will serve on the negotiating committee and releasing an issue paper to guide the first negotiating session. The paper asks the committee to consider how the Administration can help borrowers, including borrowers whose balances are greater than what they originally borrowed, who would be eligible for relief under existing repayment plans but have not applied, and who have experienced financial hardship on their loans that the current loan system doesn’t address.

To date, the Biden-Harris Administration has approved the following in debt cancellation:

- Nearly $42 billion for almost 855,000 borrowers who are eligible for forgiveness through income-driven repayment by fixing historical inaccuracies in the count of payments that qualify toward forgiveness;

- Almost $51 billion for 715,000 public servants through Public Service Loan Forgiveness (PSLF) programs, including the limited PSLF waiver and Temporary Expanded PSLF (TEPSLF);

- $11.7 billion for almost 513,000 borrowers with a total and permanent disability; an

- $22.5 billion for more than 1.3 million borrowers who were cheated by their schools, saw their institutions precipitously close, or are covered by related court settlements.

The state-by-state breakdown of relief and impacted borrowers can be found below:

| Borrowers with Processed PSLF Discharges (PSLF, TEPSLF, and limited waiver) since October 2021 by Location | ||

|---|---|---|

| State | Borrower Count | Balance Approved for Discharge (in millions) |

| Alabama | 10,700 | $831.70 |

| Alaska | 1330 | $89.5 |

| Arizona | 11,700 | $840.0 |

| Arkansas | 6,370 | $439.3 |

| California | 60,680 | $4,450.6 |

| Colorado | 13,220 | $925.0 |

| Connecticut | 8,300 | $558.1 |

| Delaware | 2,250 | $160.9 |

| District of Columbia | 4,070 | $359.9 |

| Florida | 40,410 | $3,335.6 |

| Georgia | 29,160 | $2,563.4 |

| Hawaii | 2,250 | $161.7 |

| Idaho | 3,800 | $240.4 |

| Illinois | 27,550 | $1,939.7 |

| Indiana | 13,010 | $866.5 |

| Iowa | 7,290 | $400.4 |

| Kansas | 6,910 | $434.4 |

| Kentucky | 8,790 | $561.6 |

| Louisiana | 8,940 | $704.5 |

| Maine | 3,550 | $229.8 |

| Maryland | 21,520 | $1,688.3 |

| Massachusetts | 15,460 | $1,052.7 |

| Michigan | 25,410 | $1,755.6 |

| Minnesota | 15,400 | $945.4 |

| Mississippi | 6,990 | $587.7 |

| Missouri | 15,580 | $1,039.3 |

| Montana | 2,710 | $162.6 |

| Nebraska | 4,470 | $270.9 |

| Nevada | 4,200 | $306.2 |

| New Hampshire | 3,440 | $220.1 |

| New Jersey | 17,730 | $1,199.0 |

| New Mexico | 3,890 | $259.6 |

| New York | 56,540 | $3,841.3 |

| North Carolina | 19,730 | $1,422.1 |

| North Dakota | 1340 | $81.2 |

| Ohio | 31,290 | $2,145.0 |

| Oklahoma | 6,490 | $431.7 |

| Oregon | 12,050 | $787.1 |

| Pennsylvania | 31,670 | $2,211.1 |

| Puerto Rico | 3,020 | $141.2 |

| Rhode Island | 2,230 | $151.7 |

| South Carolina | 13,170 | $1,079.5 |

| South Dakota | 2,350 | $134.2 |

| Tennessee | 12,950 | $994.7 |

| Texas | 45,600 | $3,212.5 |

| Utah | 4,000 | $281.2 |

| Vermont | 2,320 | $163.2 |

| Virginia | 23,340 | $1,622.0 |

| Washington | 15,700 | $1,048.6 |

| West Virginia | 4,160 | $244.8 |

| Wisconsin | 13,500 | $816.3 |

| Wyoming | 1030 | $60.1 |

| All Other Locations | 5,570 | $412.4 |

| Total | 715,130 | $50,861.9 |

Data as of late September 2023

The sum of individual values may not equal the total due to rounding and timing

| Borrowers Identified for Forgiveness under Income Driven Repayment Direct-to-Discharge Account Adjustment by Location | ||

|---|---|---|

| State | Borrower Count | Balance Approved for Discharge (in millions) |

| Alabama | 13,560 | $597.4 |

| Alaska | 1,050 | $55.7 |

| Arizona | 21,790 | $1,099.4 |

| Arkansas | 7,480 | $369.4 |

| California | 65,340 | $3,145.5 |

| Colorado | 15,830 | $856.9 |

| Connecticut | 7,710 | $333.5 |

| Delaware | 2,610 | $123.1 |

| District of Columbia | 2,380 | $139.8 |

| Florida | 60,410 | $3,243.4 |

| Georgia | 40,850 | $2,279.0 |

| Hawaii | 1,800 | $96.8 |

| Idaho | 5,990 | $266.2 |

| Illinois | 30,010 | $1,402.1 |

| Indiana | 20,770 | $993.9 |

| Iowa | 11,330 | $502.1 |

| Kansas | 8,960 | $454.1 |

| Kentucky | 11,830 | $480.0 |

| Louisiana | 16,330 | $890.4 |

| Maine | 5,100 | $228.3 |

| Maryland | 17,830 | $984.8 |

| Massachusetts | 13,210 | $624.4 |

| Michigan | 28,740 | $1,364.3 |

| Minnesota | 14,500 | $692.1 |

| Mississippi | 10,210 | $487.8 |

| Missouri | 20,010 | $1,026.4 |

| Montana | 3,960 | $198.8 |

| Nebraska | 5,980 | $285.4 |

| Nevada | 7,290 | $352.8 |

| New Hampshire | 3,260 | $155.1 |

| New Jersey | 18,280 | $843.1 |

| New Mexico | 5,740 | $279.0 |

| New York | 44,230 | $2,045.6 |

| North Carolina | 26,390 | $1,221.3 |

| North Dakota | 2,210 | $106.7 |

| Ohio | 39,690 | $1,861.3 |

| Oklahoma | 12,230 | $592.2 |

| Oregon | 12,430 | $607.0 |

| Pennsylvania | 32,040 | $1,444.4 |

| Puerto Rico | 3,960 | $110.6 |

| Rhode Island | 2,740 | $116.2 |

| South Carolina | 17,460 | $914.3 |

| South Dakota | 3,240 | $157.5 |

| Tennessee | 18,100 | $933.4 |

| Texas | 67,590 | $3,314.3 |

| Utah | 4,220 | $229.2 |

| Vermont | 2,060 | $102.9 |

| Virginia | 22,930 | $1,116.1 |

| Washington | 17,390 | $834.1 |

| West Virginia | 5,270 | $211.0 |

| Wisconsin | 13,130 | $623.5 |

| Wyoming | 1,320 | $67.5 |

| All Other Locations | 6,150 | $292.5 |

| Total | 854,870 | $41,752.6 |

Data as of mid-September 2023

The sum of individual values may not equal the total due to rounding and timing