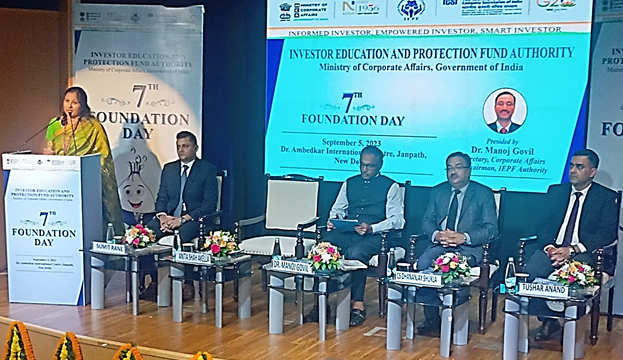

IEPFA celebrates 7th Foundation Day in New Delhi

On its 7th Foundation Day, the Investor Education and Protection Fund Authority (IEPFA), in collaboration with Institute of Company Secretaries in India (ICSI) and National Council of Applied Economic Research (NCAER), held a conference on “Understanding the Psychology of Scams: How to Avoid Fraudulent Schemes”, in New Delhi, today.

The conference garnered active participation from diverse segments, emphasising the importance of countering fraudulent schemes. Engaging discussions among experts and attendees made a significant impact.

In his keynote address during the 7th Foundation Day celebrations, Dr. Manoj Govil, Chairman, IEPFA, and Secretary, Ministry of Corporate Affairs (MCA), highlighted IEPFA’s initiatives spanning diverse societal segments – youth, homemakers, retirees, professionals, and children. He emphasised state-level programmes in untapped regions like Mizoram, Srinagar, and Bhubaneshwar, focusing on secure investment practices and the hazards of fraudulent schemes. Dr. Govil also emphasised IEPFA’s efforts in protecting forgotten claims and streamlining settlements, concluding with a call for building investor trust. With over 70,000 awareness programmes in six years impacted 30 lakh citizens, he extended best wishes for IEPFA’s 7th foundation day, anticipating more milestones ahead.

In her inaugural address, Ms. Anita Shah Akella, CEO, IEPFA, and Joint Secretary, MCA, highlighted the upcoming user-friendly portal integrating software from various stakeholders, IEPFA’s surge in innovative initiatives, and impactful programmes like Investors Handbook, Niveshak Didi, Niveshak Saarthi, and physical Investor Awareness Programmes. The success of these endeavours was reaffirmed by IIT Delhi’s Department of Management’s impact analysis, indicating over 95% satisfaction levels, Ms. Akella said. She also highlighted the substantial rise in female investor participation from 9 to 19 percent since IEPFA’s establishment in 2016.

Earlier, the conference began with a welcome address from CS Dhananjay Shukla, Council member, ICSI.

During the event, two significant educational resources were unveiled. The “Fundoo-nomics” board game, a unique initiative of IEPFA’s Media & Awareness wing based on IIT Delhi’s Department of Management findings for IEPFA’s on-ground activities; was introduced. This innovative game aims to simplify financial concepts and promote financial literacy across various age groups.

Additionally, segment-wise one-page guides (OPGs) were revealed. Tailored for students, females, the general public, and beneficiaries of government schemes, these guides offer a concise roadmap to navigate the intricate financial landscape.

The highlight of the conference was the technical session led by IEPFA research chair at NCAER, Dr. CS Mohapatra. The esteemed panel of experts included Mr. Ajay Tyagi, former SEBI Chairman, Dr. M.S. Sahoo, former IBBI Chairman and former SEBI member Mr. Dhirendra Kumar, CEO of Value Research Foundation, and Ms. Suchitra Maurya, Banking Ombudsman, Delhi, Reserve Bank of India. Prof. C S Mohapatra, IEPFA Chair Professor, moderated the session. The discussion delved deep into understanding the psychology behind fraudulent schemes and provided invaluable insights on avoiding falling victim to them.

The conference also saw active audience engagement, dynamic panel discussions on a meaningful theme, and animated interactions during the Q&A session and concluded with a vote of thanks by Lt. Col. Sumit Rane, GM of IEPFA, expressing confidence in scaling new heights in the upcoming year. The 7th Foundation Day celebrations again exemplified IEPFA’s steadfast commitment to advancing financial literacy and investor protection throughout India.

About IEPFA

The Investor Education and Protection Fund Authority (IEPFA) was set up on September 7, 2016, under the aegis of the Ministry of Corporate Affairs, Government of India, for administering the Investor Education and Protection Fund for making refunds of shares, unclaimed dividends, and matured deposits/debentures, among other things, to investors.