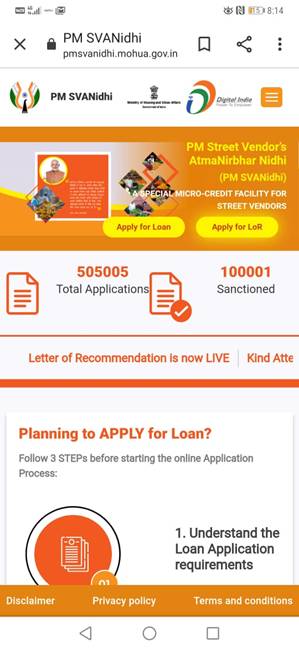

Over 5 lakh applications received under PM SVANidhi scheme

New Delhi: The number of loan sanctions and number of applications received under PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) scheme have crossed the mark of 1 lakh and 5 lakhs respectively within 41 days of commencement of the lending process on July 02, 2020. The PM SVANidhi scheme has generated considerable enthusiasm among the street vendors, who have been looking for access to affordable working capital credit for re-starting their businesses post COVID-19 lockdown.

The PM SVANidhi Scheme was launched by Ministry of Housing & Urban Affairs under the ambit of ‘AtmaNirbhar Bharat Abhiyan’. It aims at facilitating collateral free working capital loans upto Rs 10,000 of 1 year tenure, to about 50 lakh street vendors in the urban areas, including those from the surrounding peri-urban/ rural areas, to resume their businesses post COVID-19 lockdown. Incentives in the form of interest subsidy @ 7% per annum on regular repayment of loan, cashback upto Rs 1,200 per annum on undertaking prescribed digital transactions and eligibility for enhanced next tranche of loan have also been provided.

PM SVANidhi Scheme envisages bringing ‘Banks at the door steps’ of these ‘nano-entrepreneurs’ by engaging the Non-Banking Financial Companies (NBFCs) and the Micro-Finance Institutions (MFIs) as lending institutions in addition to Scheduled Commercial Banks – Public & Private, Regional Rural Banks, Cooperative Banks, SHG Banks etc. The onboarding of the vendors on digital payment platforms is a very important component to build the credit profile of the vendors to help them become part of the formal urban economy.

Small Industries Development Bank of India (SIDBI) is the implementation partner for the scheme. A graded guarantee cover is provided, on portfolio basis, to these lending institutions through Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) to encourage lending to street vendors.

The street vendors mostly operate their businesses on very thin margins. The micro-credit support under the scheme is expected to provide not only major relief to such vendors but also help them climb the economic ladder. Use of an integrated IT Platform (pmsvanidhi.mohua.org.in), Web Portal and Mobile App, has enabled the Scheme to extend its reach and benefits to this segment of society with the objective of minimum government and maximum governance.