PM MUDRA Yojana Loan Limit Increased to ₹20 Lakh to Empower Small and Micro Enterprises

The Pradhan Mantri MUDRA Yojana (PMMY), launched by the Prime Minister on April 8, 2015, has played a pivotal role in empowering non-corporate, non-farm small and micro enterprises by providing loans of up to ₹10 lakh. To strengthen support for aspiring entrepreneurs, the finance minister announced an increase in the loan limit to ₹20 lakh during the Union Budget 2024-25 on July 23, 2024. This new limit took effect on October 24, 2024.

This announcement also introduces a new loan category, Tarun Plus, designed specifically for those who have previously availed and successfully repaid loans under the Tarun category, allowing them to access funding between ₹10 lakh and ₹20 lakh. Additionally, the Credit Guarantee Fund for Micro Units (CGFMU) will now provide guarantee coverage for these enhanced loans, further reinforcing the government’s commitment to nurturing a robust entrepreneurial ecosystem in India.

Mudra Yojana

MUDRA,3 which stands for Micro Units Development & Refinance Agency Ltd, is a financial institution set up by the Government of India under PMMY for development and refinancing micro unit enterprises. PMMY aims to provide financial inclusiveness and support to the marginalized and hitherto socio-economically neglected classes. PMMY has given wings to the dreams and aspirations of millions, along with a feeling of self-worth and independence.

Need for the MUDRA Yojana

India is a young country brimming with youthful enthusiasm and aspirations. In order to provide a fertile ground for sowing the seeds of India’s development it is very important to harness this innovative zeal of young India which can provide new age solutions to existing gaps in the economic ecosystem of the country. Understanding the need to harness the latent potential of entrepreneurship in India, the Union Government launched the Pradhan Mantri MUDRA Yojana.

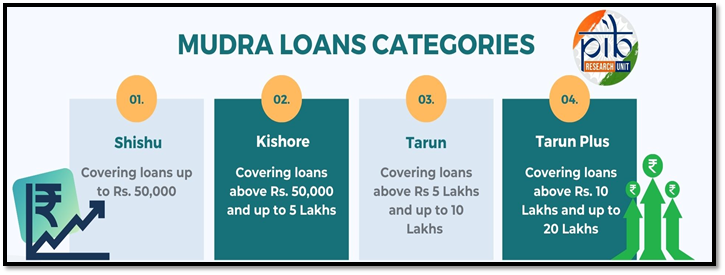

MUDRA Loans: Categories

Under PMMY collateral free loans up to Rs. 20 Lakh are extended by Member Lending Institutions (MLIs) viz Scheduled Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks (SFBs), Non-Banking Financial Companies (NBFCs), Micro Finance Institutions (MFIs) etc. The loans are given for income generating activities in manufacturing, trading and services sectors and for activities allied to agriculture.

MUDRA loans now will be offered in four categories namely, ‘Shishu’, ‘Kishore’and ‘Tarun’ and newly added category ‘Tarun Plus’ which signifies the stage of growth or development and funding needs of the borrowers:-

- Shishu: covering loans upto Rs. 50,000/-

- Kishore: covering loans above Rs. 50,000/- and up to Rs. 5 lakhs

- Tarun: covering loans above Rs. 5 lakh and up to Rs. 10 lakhs

- Tarun Plus: Rs. 10 lakh and up to Rs. 20 lakhs

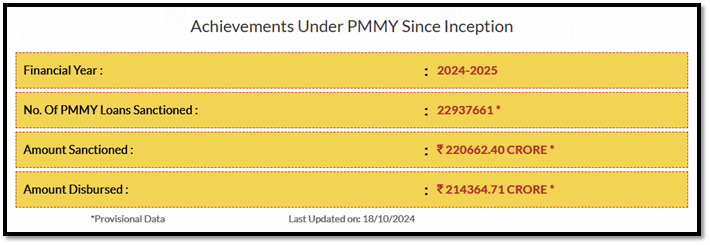

Achievements of PMMY

Under Pradhan Mantri Mudra Yojana (PMMY) amount sanctioned and disbursed in the financial year 2023-24 under various categories:[4]

- Women Borrowers: A total of ₹1,08,472.51 crore was disbursed under the Shishu category, ₹1,00,370.49 crore under Kishore, and ₹13,454.27 crore under the Tarun category.

- Minority Borrowers: The disbursements amounted to ₹15,759.66 crore under Shishu, ₹20,766.3 crore under Kishore, and ₹8562.27 crore under Tarun.

- New Entrepreneurs / Accounts:

- Shishu category: 88,49,101 accounts with a sanctioned amount of ₹29,445.41 crore and disbursed amount of ₹28,839.75 crore.

- Kishore category: 34,06,239 accounts with ₹62,290.58 crore sanctioned and ₹60,407.02 crore disbursed.

- Tarun category: 7,57,456 accounts with a sanctioned amount of ₹70,294.35 crore and ₹68,861.13 crore disbursed.

- Unique Borrowers (from 8th April 2015 to 31st March 2024):

- ₹44,891.82 crore was sanctioned under Shishu.

- ₹24,575.57 crore was sanctioned under Kishore.

- ₹19,120.58 crore was sanctioned under Tarun.

Mudra Card

MUDRA Card[5] is an innovative credit product wherein the borrower can avail of credit in a hassle free and flexible manner. It provides a facility of working capital arrangement in the form of an overdraft facility to the borrower. Since MUDRA Card is a RuPay debit card, it can be used for drawing cash from ATM or Business Correspondent or make purchase using Point of Sale (POS) machine. Facility is also there to repay the amount, as and when, surplus cash is available, thereby reducing the interest cost.

MUDRA Card[5] is an innovative credit product wherein the borrower can avail of credit in a hassle free and flexible manner. It provides a facility of working capital arrangement in the form of an overdraft facility to the borrower. Since MUDRA Card is a RuPay debit card, it can be used for drawing cash from ATM or Business Correspondent or make purchase using Point of Sale (POS) machine. Facility is also there to repay the amount, as and when, surplus cash is available, thereby reducing the interest cost.

MUDRA App- “MUDRA MITRA”

MUDRA MITRA is a mobile phone application available in Google Play Store and Apple App Store, providing information regarding ‘Micro Units Development and RefinanceAgency Ltd. (MUDRA)’ and its various products/ schemes. It will guide a loan seeker to approach a Banker in availing MUDRA loan under PMMY. Users can also access useful loan related material including sample loan application forms in this app.

Steps taken to improve implementation of the Scheme:[6]

- Handholding support for facilitating submission of loan applications

- Provision for online applications through PSBloansin59minutes and Udyamimitra portal

- Intensive publicity campaigns for increased visibility of the scheme amongst the stakeholders

- Simplification of application forms

- Nomination of MUDRA Nodal Officers in Public Sector Banks (PSBs)

- Periodic monitoring of performance of PSBs with regard to PMMY

- Interest Subvention of 2% on prompt repayment of Shishu loans extended under PMMY for a period of 12 months to all eligible borrowers.

- Announced by Union Finance Minister on 14.05.2020 under Aatmanirbhar Bharat Package, the scheme has been formulated as a specific response to an unprecedented situation and aims to alleviate financial stress for borrowers at the ‘bottom of the pyramid’ by reducing their cost of credit.

Conclusion