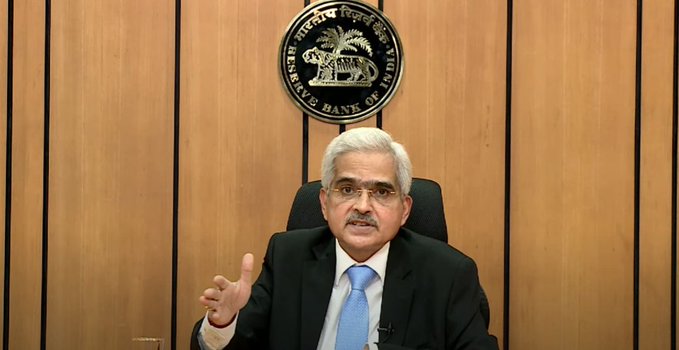

RBI cuts reverse repo rate from 4% to 3.75%: Governor Shaktikanta Das

Mumbai: RBI cuts reverse repo rate from 4% to 3.75% announced by the RBI Governor Shaktikanta Das.It has been decided to reduce the fixed reverse repo rate under liquidity adjustment facility (LAF) by 25 basis points from 4% to 3.75%, with immediate effect says RBI Governor Shaktikanta Das

“Targeted long term repo operations to the tune of Rs 50,000, to begin with. Based on our how the market uses it the RBI may scale up the amount,”

said RBI Governor Shaktikanta Das. Special refinance facility of Rs 50,000 crore to NABARD, SIDBI, NHB .

Today humanity is facing the trial of its time, as #COVID19 grips the world with its deadly embrace. In this kind of environment Reserve Bank of India (RBI) has been very proactive & monitoring the situation closely says RBI Governor Shaktikanta Das. RBI has been proactive and has been monitoring the situation closely says RBI Governor Shaktikanta Das. – Ways and means limit of states raised to help them, not bunch up their borrowing plans says RBI Governor Shaktikanta Das. Reserve Bank of India (RBI) Governor Shaktikanta Das said that the IMF’s projection of 1.9 percent GDP growth for India is the highest of all G20 countries and that a sharp turnaround is expected in 2021-22.

90-day NPA norm not to apply on moratorium granted on existing loans by banks, says RBI Governor Shaktikanta Das.

Since March 27, the macroeconomic and financial landscape has deteriorated precipitously in some areas, but light still shines through bravely in some others says Reserve Bank of India (RBI) Governor Shaktikanta Das.

RBI Governor’s Statement, April 17, 2020

Today, humanity faces perhaps the trial of its time as COVID-19 grips the world

in its deadly embrace. Everywhere, as also in India, the mission is to do whatever it

takes to prevent epidemiological curve from steepening any further. Human spirit is

ignited by the resolve to overcome the pandemic. It is during our darkest moments

that we must focus on the light. As Mahatma Gandhi said in his famous address at

Kingsley Hall, London in October 1931: “…In the midst of death life persists, in the

midst of untruth truth persists, in the midst of darkness light persists.”

2. Before I begin, I wish to place on record our gratitude to all functionaries and personnel

in the government, the private sector, banks and other financial institutions who risk

their lives on a daily basis by going to work or by working from home to fight the

pandemic by keeping essential services operational. Our deepest appreciation goes

out to doctors, healthcare and medical staff, police and law enforcement agencies who

are at the frontline. In the RBI, I would like to specially commend and thank our team

of 150 officers, staff and service providers who are in quarantine, away from families,

and are at work 24X7 to keep essential services such as currency in circulation, retail

and wholesale payment and settlement systems, reserve management, financial

markets and liquidity management, financial regulation and supervision, and a host of

other services available so that the nation may survive COVID-19. Banks and financial

institutions have risen to the occasion and have ensured normal functioning. Their

efforts are praiseworthy. I would also like to thank my colleagues in the RBI who set

aside personal health concerns and join me in fashioning the array of measures taken

by the RBI in the context of COVID-19. I also thank our teams for their intellectual

support, analytical work and logistical arrangements.

I. Assessment of the Current Economic Situation

3. Since March 27, 2020 when I spoke to you last, the macroeconomic and financial

landscape has deteriorated, precipitously in some areas; but light still shines through

bravely in some others. On April 14, the IMF released its global growth projections,

revealing that in 2020, the global economy is expected to plunge into the worst

recession since the Great Depression, far worse than the Global Financial Crisis. The

IMF’s Economic Counsellor has named it the ‘Great Lockdown’, estimating the

cumulative loss to global GDP over 2020 and 2021 at around 9 trillion US dollars –

greater than the economies of Japan and Germany, combined. Within this downturn,

2

the projections are replete with even sharper declines in output in various countries.

India is among the handful of countries that is projected to cling on tenuously to

positive growth (at 1.9 per cent). In fact, this is the highest growth rate among the G

20 economies. The World Trade Organisation sees global merchandise trade

contracting by as much as 13-32 per cent in 2020. Global financial markets remain

volatile, and emerging market economies are grappling with capital outflows and

volatile exchange rates. Crude oil prices remain in a state of flux, despite the

agreement on production cuts by OPEC plus countries. For 2021, the IMF projects

sizable V-shaped recoveries: close to 9 percentage points for global GDP. India is

expected to post a sharp turnaround and resume its pre-COVID pre-slowdown

trajectory by growing at 7.4 per cent in 2021-22.

4. Over the last three weeks, there have been a few data releases on domestic

developments, but they are too disjointed to allow a comprehensive assessment of the

state of the economy. Yet, there are a few slivers of brightness amidst the encircling

gloom. In my statement of March 27, I had referred to the continuing resilience of

agriculture and allied activities on the back of all-time highs in the production of food

grains and horticulture, with huge buffer stocks of rice and wheat far in excess of the

buffer norms. By April 10, pre-monsoon kharif sowing had begun strongly, with

acreage of paddy – the principal kharif crop – up by 37 per cent in comparison with

the last season1. States such as West Bengal, Telangana, Odisha, Assam, Karnataka

and Chhattisgarh are leading in sowing activity despite the lockdown. On April 15, the

India Meteorological Department (IMD) forecast a normal south west monsoon for the

2020 season, with rainfall expected to be 100 per cent of the long period average.

These early developments bode well for rural demand, supported as they are by

accelerating fertiliser production up to February 2020. The robust growth of 21.3 per

cent in tractor sales up to February 2020 – as against a contraction of 0.5 per cent in

April-February last year – may provide an offset to farm labour shortages on account

of the lockdown.

5. In other production sectors, the situation is more sombre. On April 9, the index of

industrial production for February was released, showing that industrial output

accelerated to its highest rate in seven months. The impact of COVID-19 is not yet

captured in these prints. More tellingly, however, the revival in electricity generation –

1 Ministry of Agriculture and Farmers’ Welfare

3

a coincident indicator of demand – that had commenced from January 2020, has been

halted by a sharp fall in daily demand in the range of 25-30 per cent after the lockdown

announcement on March 25, 2020. Automobile production and sales, and port freight

traffic declined sharply in March, as recently released data indicate. The

manufacturing purchasing mangers’ index (PMI) for March 2020, which was released

on April 2, was the lowest in the last four months. Notably, suppliers’ delivery time

lengthened for the first time in five months, indicating supply disruptions. The April 6

release showed that the services PMI declined into contraction in March 2020, pulled

down by a sharp downturn in export business, new domestic orders and employment.

6. In the external sector, the contraction in exports in March 2020 at (-) 34.6 per cent

has turned out to be much more severe than during the global financial crisis. Barring

iron ore, all exporting sectors showed a decline in outbound shipments. Merchandise

imports also fell by 28.7 per cent in March across the board, barring transport

equipment. Consequently, the trade deficit declined to US$ 9.8 billion in March 2020

from US$ 11.0 billion a year ago. Net foreign direct investment inflows amounted to

US$ 40.6 billion during 2019-20 (April-February), up from US$ 29.9 billion a year ago.

In February, net FDI was of the order of US$ 2.9 billion as compared with US$ 1.9

billion a year ago. Net foreign portfolio investment in equities recorded inflow of US$

0.4 billion during 2020-21 (till April 9) as against the inflow of US$ 0.2 billion a year

ago. Portfolio debt investment recorded an outflow of US$ 0.7 billion as against net

outflow of US$ 0.9 billion a year ago. In addition, net investment by FPIs under

voluntary retention route (VRR) was US$ 0.1 billion during the same period. The level

of foreign exchange reserves continue to be robust at US $ 476.5 billion on April 10,

2020 equivalent to 11.8 months of imports.

7. Turning to the status of banking operations since the nationwide lockdown was

imposed by the Government of India from March 25, 2020, the RBI has taken a number

of steps to ensure normal business functioning by the entire banking sector. As a

result, the payment infrastructure is running seamlessly. Banks have been required to

put in place business continuity plans to operate from their disaster recovery (DR)

sites and/or to identify alternate locations for critical operations so that there is no

disruption in customer services. Our data show that there was no downtime of internet

or mobile banking. On an average, ATM operations stood at over 91 per cent of full

capacity. The average availability of Business Correspondents (BCs) is over 80 per

cent. Regional offices of the RBI have supplied fresh currency of `1.2 lakh crore

4

from March1 till April 14, 2020 to currency chests across the country to meet increased

demand for currency in the wake of the COVID-19 pandemic. Banks have risen to the

occasion by refilling ATMs regularly, despite logistical challenges.

8. In my statement of March 27, I had indicated that together with the measures

announced on March 27, the RBI’s liquidity injection was about 3.2 per cent of GDP

since the February 2020 MPC meeting. Since then, surplus liquidity in the banking

system has increased sharply in the wake of sustained government spending.

Systemic liquidity surplus, as reflected in net absorptions under the LAF, averaged

`4.36 lakh crore during the period March 27- April 14, 2020. As announced on March

27, the RBI undertook three auctions of targeted long term repo operations (TLTRO),

injecting cumulatively `75,041 crore to ease liquidity constraints in the banking system

and de-stress financial markets. Another TLTRO auction of `25,000 crore will be

conducted today (April 17). In response to these auctions, financial conditions have

eased considerably, as reflected in the spreads on money and bond market

instruments. Moreover, activity in the corporate bond market has picked up

appreciably, with several corporates making new issuances. There are also indications

that redemption pressures faced by mutual funds have moderated.

II. Additional Measures

9. Against this backdrop and based on our continuing assessment of the macroeconomic

situation and financial market conditions, we propose to take further measures to (i)

maintain adequate liquidity in the system and its constituents in the face of COVID-19

related dislocations; (ii) facilitate and incentivise bank credit flows; (iii) ease financial

stress; and (iv) enable the normal functioning of markets.

II(A). Liquidity Management

10.The RBI has moved in a calibrated fashion to ensure conducive financial conditions

and normalcy in the functioning of financial markets and institutions. The initial efforts

to provide adequate system level liquidity are reflected in the sizable net absorptions

under reverse repo operations. With this achieved, the RBI has undertaken measures

to target liquidity provision to sectors and entities which are experiencing liquidity

constraints and/or hindrances to market access. Long term repo operations (LTROs)

to ensure adequate liquidity at the longer end of the yield curve, exemptions from the

cash reserve ratio for the equivalent of incremental credit disbursed by banks as loans

5

in certain select areas/segments and targeted LTROs or TLTROs fall in this class of

sector-specific measures. It is, however, observed that the deployment of TLTRO

funds so far has largely been to bonds issued by public sector entities and large

corporates, especially in primary issuances. The disruptions caused by COVID-19

have, however, more severely impacted small and mid-sized corporates, including

non-banking financial companies (NBFCs) and micro finance institutions (MFIs), in

terms of access to liquidity.

Targeted Long Term Operations (TLTRO) 2.0

11.Accordingly, it has been decided to conduct targeted long-term repo operations

(TLTRO 2.0) for an aggregate amount of `50,000 crore, to begin with, in tranches of

appropriate sizes. The funds availed by banks under TLTRO 2.0 should be invested

in investment grade bonds, commercial paper, and non-convertible debentures of

NBFCs, with at least 50 per cent of the total amount availed going to small and midsized NBFCs and MFIs. The guidelines will spell out the details. These investments

have to be made within one month of the availment of liquidity from the RBI. As in the

case of TLTRO auctions conducted hitherto, investments made by banks under this

facility will be classified as held to maturity (HTM) even in excess of 25 per cent of total

investment permitted to be included in the HTM portfolio. Exposures under this facility

will also not be reckoned under the large exposure framework. Notification for the first

TLTRO 2.0 auction will be issued today.

Refinancing Facilities for All India Financial Institutions (AIFIs)

12.All India financial institutions (AIFIs) such as the National Bank for Agriculture and

Rural Development (NABARD), the Small Industries Development Bank of India

(SIDBI) and the National Housing Bank (NHB) play an important role in meeting the

long-term funding requirements of agriculture and the rural sector, small industries,

housing finance companies, NBFCs and MFIs. These All India Financial Institutions

raise resources from the market through specified instruments allowed by the Reserve

Bank, in addition to relying on their internal sources. In view of the tightening of

financial conditions in the wake of the COVID-19 pandemic, these institutions are

facing difficulties in raising resources from the market. Accordingly, it has been

decided to provide special refinance facilities for a total amount of `50,000 crore to

6

NABARD, SIDBI and NHB to enable them to meet sectoral credit needs. This will

comprise `25,000 crore to NABARD for refinancing regional rural banks (RRBs),

cooperative banks and micro finance institutions (MFIs); `15,000 crore to SIDBI for

on-lending/refinancing; and `10,000 crore to NHB for supporting housing finance

companies (HFCs). Advances under this facility will be charged at the RBI’s policy

repo rate at the time of availment.

Liquidity Adjustment Facility: Fixed Rate Reverse Repo Rate

13.As I have mentioned earlier, the surplus liquidity in the banking system has risen

significantly in the wake of government spending and the various liquidity enhancing

measures undertaken by the RBI. On April 15, the amount absorbed under reverse

repo operations was `6.9 lakh crore. In order to encourage banks to deploy these

surplus funds in investments and loans in productive sectors of the economy, it has

been decided to reduce the fixed rate reverse repo rate under the liquidity adjustment

facility (LAF) by 25 basis points from 4.0 per cent to 3.75 per cent with immediate

effect. The policy repo rate remains unchanged at 4.40 per cent, and the marginal

standing facility rate and the Bank Rate remain unchanged at 4.65 per cent.

Ways and Means Advances for States

14. On April 1, 2020 the RBI had announced an increase in the ways and means

advances (WMA) limit of states by 30 per cent. It has now been decided to increase

the WMA limit of states by 60 per cent over and above the level as on March 31, 2020

to provide greater comfort to the states for undertaking COVID-19 containment and

mitigation efforts, and to plan their market borrowing programmes better. The

increased limit will be available till September 30, 2020.

II(B). Regulatory Measures

15.On March 27, 2020 the Reserve Bank had announced certain regulatory measures to

mitigate the burden of debt servicing brought about by disruptions on account of

COVID-19 and to ensure the continuity of viable businesses. Based on a review of the

rapidly evolving situation, and consistent with the globally coordinated action

committed to by the Basel Committee on Banking Supervision to alleviate the impact

7

of Covid-19 on the global banking system, additional regulatory measures are being

announced today.

Asset Classification

16.Economic activity has come to a standstill during the period of the lockdown, with

consequential lingering effects which have unambiguously affected the cash flows of

households and businesses. On March 27, 2020 the RBI had permitted lending

institutions (LIs) to grant a moratorium of three months on payment of current dues

falling between March 1 and May 31, 2020. It is recognized that the onset of COVID19 has also exacerbated the challenges for such borrowers even to honour their

commitments fallen due on or before February 29, 2020 in Standard Accounts. The

Basel Committee on Banking Supervision (BCBS) has taken cognizance of the

financial and economic impact of COVID-19 and very recently announced that “……….

the payment moratorium periods (Public or granted by banks on a voluntary basis)

relating to the COVID-19 outbreak can be excluded by banks from the number of days

past due” in respect of NPA recognition.

17.Therefore, it has been decided that in respect of all accounts for which lending

institutions decide to grant moratorium or deferment, and which were standard as on

March 1, 2020, the 90-day NPA norm shall exclude the moratorium period, i.e., there

would an asset classification standstill for all such accounts from March 1, 2020 to

May 31, 2020. NBFCs, which are required to comply with Indian Accounting Standards

(IndAS), may be guided by the guidelines duly approved by their boards and as per

advisories of the Institute of Chartered Accountants of India (ICAI) in recognition of

impairments. In other words, NBFCs have flexibility under the prescribed accounting

standards to consider such relief to their borrowers.

18.At the same time, we are cognizant of the risk build-up in banks’ balance sheets on

account of firm-level stress and delays in recoveries. With the objective of ensuring

that banks maintain sufficient buffers and remain adequately provisioned to meet

future challenges, they will have to maintain higher provision of 10 per cent on all such

accounts under the standstill, spread over two quarters, i.e., March, 2020 and June,

2020. These provisions can be adjusted later on against the provisioning requirements

for actual slippages in such accounts.

8

Extension of Resolution Timeline

19.Under RBI’s prudential framework of resolution of stressed assets dated June 7, 2019,

in the case of large accounts under default, Scheduled Commercial Banks, AIFIs,

NBFC-ND-SIs and NBFC-D are currently required to hold an additional provision of 20

per cent if a resolution plan has not been implemented within 210 days from the date

of such default. Recognizing the challenges to resolution of stressed assets in the

current volatile environment, it has been decided that the period for resolution plan

shall be extended by 90 days. Details will be spelt out in the circular.

Distribution of Dividend

20.It is imperative that banks conserve capital to retain their capacity to support the

economy and absorb losses in an environment of heightened uncertainty. It has,

therefore, been decided that in view of the COVID-19-related economic shock,

scheduled commercial banks and cooperative banks shall not make any further

dividend payouts from profits pertaining to the financial year ended March 31, 2020

until further instructions. This restriction shall be reviewed on the basis of the financial

position of banks for the quarter ending September 30, 2020.

Liquidity Coverage Ratio

21.The Reserve Bank has been proactively taking measures to address the systemic

liquidity issues through a slew of monetary and market operations. In order to ease

the liquidity position at the level of individual institutions, the LCR requirement for

Scheduled Commercial Banks is being brought down from 100 per cent to 80 per cent

with immediate effect. The requirement shall be gradually restored back in two phases

– 90 per cent by October 1, 2020 and 100 per cent by April 1, 2021.

NBFC Loans to Commercial Real Estate Projects

22.In terms of the extant guidelines for banks, the date for commencement for commercial

operations (DCCO) in respect of loans to commercial real estate projects delayed for

reasons beyond the control of promoters can be extended by an additional one year,

over and above the one-year extension permitted in normal course, without treating

the same as restructuring. It has now been decided to extend a similar treatment to

loans given by NBFCs to commercial real estate. This will provide relief to NBFCs as

well as the real estate sector.

9

III. Concluding Remarks

23.In conclusion, I would like to review recent developments relating to inflation and the

outlook without infringing in any way on the mandate of the monetary policy committee

(MPC). The press release of the National Statistics Office (NSO) on April 13, 2020

showed that CPI inflation for March 20202 declined by 70 basis points to 5.9 per cent.

This is, however, based on data gathered up to 19th March, 2020. The data showed a

softening of food inflation by around 160 basis points on account of the easing of prices

of vegetables, eggs, meat, fish, pulses, oils and fats, fruits and sugar. In other

categories of the CPI, inflation pressures remained firm. Daily data on 22 essential

food items covered by the Department of Consumer Affairs (DCA) suggest that food

prices have increased by 2.3 per cent in April so far (up to April 13, 2020) in a broadbased manner, though onion prices have continued to decline while PDS kerosene

prices have slumped by 24 per cent in the first fortnight of April. Domestic LPG prices

also declined by 8 per cent. These early developments suggest that inflation is on a

declining trajectory, having fallen by 170 basis points from its January 2020 peak.

24.In the period ahead, inflation could recede even further, barring supply disruption

shocks and may even settle well below the target of 4 per cent by the second half of

2020-21. Such an outlook would make policy space available to address the

intensification of risks to growth and financial stability brought on by COVID-19. This

space needs to be used effectively and in time.

25.The RBI will monitor the evolving situation continuously and use all its instruments to

address the daunting challenges posed by the pandemic. The overarching objective

is to keep the financial system and financial markets sound, liquid and smoothly

functioning so that finance keeps flowing to all stakeholders, especially those that are

disadvantaged and vulnerable. Regulatory measures that have been announced so

far – including those made today – are dovetailed into the objective of preserving

financial stability. Although social distancing separates us, we stand united and

resolute. Eventually, we shall cure; and we shall endure.

Thank you.

2 Owing to nation-wide lockdown to contain the spread of COVID-19, the field work for price collection of

Consumer Price Index (CPI) was suspended with effect from 19th March 2020. As a result, only 66 per cent of

price quotations were available for compiling the CPI for the month of March 2020