Share Pledging and its consequences: A study of Indian firms by ISB

“Policy makers and investors need to take a more balanced and contextual view on share pledging by family promoters rather than castigating the phenomenon.”

New Delhi: A research study, authored by Dr. Nupur Pavan Bang, Professor Sougata Ray, Nandil Bhatia and Professor Kavil Ramachandran of the Thomas Schmidheiny Centre for Family Enterprise at the Indian School of Business (ISB), highlights the prevalence of share pledging in the Indian context and the possible implications that pledging may present for stakeholders, especially in family firms.

Using data for 1,492 firms listed on the National Stock Exchange of India from 2009 to 2019, the study finds a decline in firm value, higher crash risk and underinvestment in innovation by firms where promoters of family firms pledge their shares. The study also shows how some firms have utilized share pledging by family promoters as a tool to raise capital for strategic projects and create value for the stakeholders. Please find the study attached for your ready reference.

The various scandals, loss of control of the firm by family promoters, regulatory responses and warnings led to the common perception that all share pledges by promoters are bad. Existing empirical research around pledging of shares is sparse and does not account for the heterogeneity among the possible use-cases of capital obtained from pledging of shares. The study calls for more nuanced studies on pledging to explore this anomaly contextually and to avoid painting all cases with the same brush.

Co-author, Professor Sougata Ray explains that “the commonly peddled negative narrative on pledging often dissuades fact based, informed, balanced, and nuanced debates on its utility, causes and consequences, backed by rigorous research in spite of its ubiquity in India and many other economies of the world. Along with large sample data driven research, there is a need for case study based research on pledging in order to understand the variations of the same.”

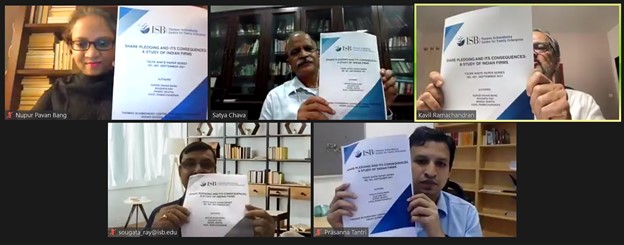

The study was released in a webinar in the presence of Dr. Satyanarayana Chava, Founder and CEO, Laurus Labs; Professor Prasanna Tantri, Executive Director, Centre for Analytical Finance, ISB; the authors of the study; and industry stakeholders. It has important implications for investors, regulators, board of directors, and even family members. Pledging of shares, coupled with bad decision-making and/or over ambitious growth plans, resulted in complete destruction of family wealth in many family firms. There is need to create awareness and build stronger family governance processes that would put checks and balances with regards to excessive pledging.

Speaking at the webinar, Dr. Nupur Pavan Bang said, “The study provides a clarion call for acknowledging that pledging is an important tool to access financial capital for family promoters. It is a legitimate way to raise entrepreneurial financing amongst family businesses and a source of fund to turnaround the family firm if it is in trouble. Policy makers and investors need to take a more balanced and contextual view on share pledging by family promoters rather than castigating the phenomenon.”

The study lists important implications for stakeholders of family firms, such as, promoters, family members of the promoting family, investors, the firm’s board of directors, and the regulators. A few of them include:

Over-optimistic investment plans and over-pledging of shares by the promoters, without pre-planned repayment strategies, are likely to lead to a crisis later.

Investors must keep a track of their portfolio and regularly evaluate if the controlling shareholders of the firms in which they have invested have pledged their shares.

Board of directors of firms must caution controlling shareholders from over pledging their stakes and should shield the firm from such shareholders if they try to manage the margin calls by taking hasty or short-term view decisions in the firm.

The study also has insights for the regulators such as the RBI and SEBI to take more balanced view of pledging when making policies.

Further, there is need to create awareness and build stronger family governance processes that would put checks and balances with regards to excessive pledging.