Union Budget 2024-25: Advancing Economic Growth through Infrastructure Initiatives

The Union Minister of Finance and Corporate Affairs, Smt. Nirmala Sitharaman, presented the Union Budget 2024-25 in Parliament today. This budget envisions sustained efforts across nine key priorities to generate ample opportunities for all, in pursuit of ‘Viksit Bharat.’ The key priorities include Productivity and Resilience in Agriculture, Employment & Skilling, Inclusive Human Resource Development and Social Justice, Manufacturing & Services, Urban Development, Energy Security, Infrastructure, Innovation, Research & Development, and Next Generation Reforms. Among these, significant announcements have been made in relation to the infrastructure sector.

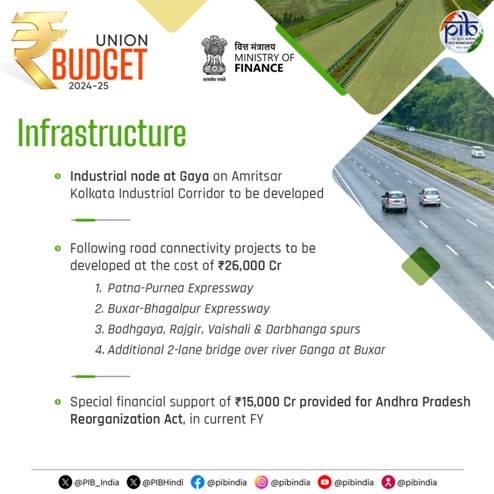

Infrastructure Development

The Finance Minister emphasized the significant investment the Central Government has made over the years in building and improving infrastructure, which has had a strong multiplier effect on the economy. The government will maintain strong fiscal support for infrastructure over the next five years, while balancing other priorities and fiscal consolidation. An allocation of ₹11,11,111 crore for capital expenditure, which is 3.4 percent of GDP, has been made this year.

The government will encourage states to provide similar scale support for infrastructure, aligning with their development priorities. A provision of ₹1.5 lakh crore for long-term interest-free loans has been made this year to assist states in their resource allocation. Investment in infrastructure by the private sector will be promoted through viability gap funding and supportive policies and regulations. A market-based financing framework will also be introduced.

Despite many financial innovations in infrastructure financing in the recent years, capital expenditure by the Union and State Governments still has the central role in funding of large-scale infrastructure projects. The capital expenditure of the Union Government increased by 2.2 times from FY21 to FY24 (PA) while that of the State governments increased by 2.1 times during the same period.

The net flow of funds to infrastructure sectors through bank credit between March 2023 to March 2024 was only around ₹79,000 crore, much less than the GBS by the Union Government for either railways or roads. The net flow of bank credit between March 2020 and March 2024 was concentrated in only a few sectors roads, airports and power. However, the credit growth to infrastructure sectors in FY24 recovered to 6.5 per cent, as against the growth of 2.3 per cent,

in FY23.

The gross inflow of external commercial borrowings to infrastructure sectors also picked up to USD 9.05 billion in FY24, as against an average of USD 5.91 billion during FY20 to FY23. The resource mobilisation by infrastructure sectors through debt and equity issuances in the capital market was just over ₹1,00,000 crore during FY24. Real estate investment trusts REITs) have raised ₹18,840 crore from year 2019 to 2024 while Infrastructure investment trusts (InvITs) raised a total of ₹1,11,294 crore in the last five years (2019-2024).

Existing Mechanisms for Fostering Public Private Partnership (PPP)

- Public Private Partnership Appraisal Committee (PPPAC)

- Apex body for appraisal of central sector PPP projects.

- 77 projects with a total cost of ₹2.4 lakh crore were recommended from FY15 to FY24.

- Viability Gap Funding (VGF)

- Assistance to financially unviable but socially/economically desirable PPP projects.

- 57 projects costing ₹64,926. One crore was granted in-principle approval and 27 projects costing ₹25,263.8 crore were granted final approval from FY15 to FY24.

- Total VGF approval of ₹5,813.6 crore (both Union Government & State share) from FY15 to FY24.

- India Infrastructure Project Development Fund Scheme

- Financial support for project development of PPP Projects

- Notified in November 2022 with a total outlay of ₹150 crore for three years from FY23 to FY25.

- 28 proposals have been approved.

- National Monetisation Pipeline (NMP)

- NMP was announced in August 2021 on the principle of ‘asset creation through monetisation’ i.e., tapping private sector investment for new infrastructure creation.

- The aggregate monetisation potential under NMP was estimated at ₹6.0 lakh crore through core assets of the Government, over four-years from FY22 to FY25.

- Other Supportive instruments

- Reference guides for setting up state PPP units, PPP project appraisal, and project implementation mode selection have been made.

- Web-based toolkits, post-award contract management toolkit and contingent liability for project sponsoring authorities have been developed to help them in PPP structuring.

Pradhan Mantri Gram Sadak Yojana (PMGSY)

The Finance Minister in the Union budget announced that Phase IV of PMGSY will be launched to provide all-weather connectivity to 25,000 rural habitations which have become eligible in view of their population increase.

The Pradhan Mantri Gram Sadak Yojana, launched on 25th December 2000, aims to provide all-weather access to eligible unconnected habitations and is a 100% Centrally Sponsored Scheme. As of July 23, 2024, 8,10,083 km of road has been sanctioned, with 7,65,530 km completed. A total of ₹3,24,177 crore has been spent on this scheme.

Irrigation and Flood Mitigation

For irrigation and flood mitigation in Bihar, the government will provide financial support for projects with an estimated cost of ₹11,500 crore through the Accelerated Irrigation Benefit Programme and other sources. This includes the Kosi-Mechi intra-state link and 20 other ongoing and new schemes. The Union budget also announced assistance for flood management, landslides, and related projects in Assam, Himachal Pradesh, Uttarakhand, and Sikkim.

The Union Budget 2024-25 demonstrates a strong commitment to advancing infrastructure and economic growth. The continued emphasis on public-private partnerships and infrastructure investment reflects the government’s vision of a ‘Viksit Bharat.’ With sustained efforts and strategic initiatives, India is well-positioned to achieve significant economic progress and development in the coming years.