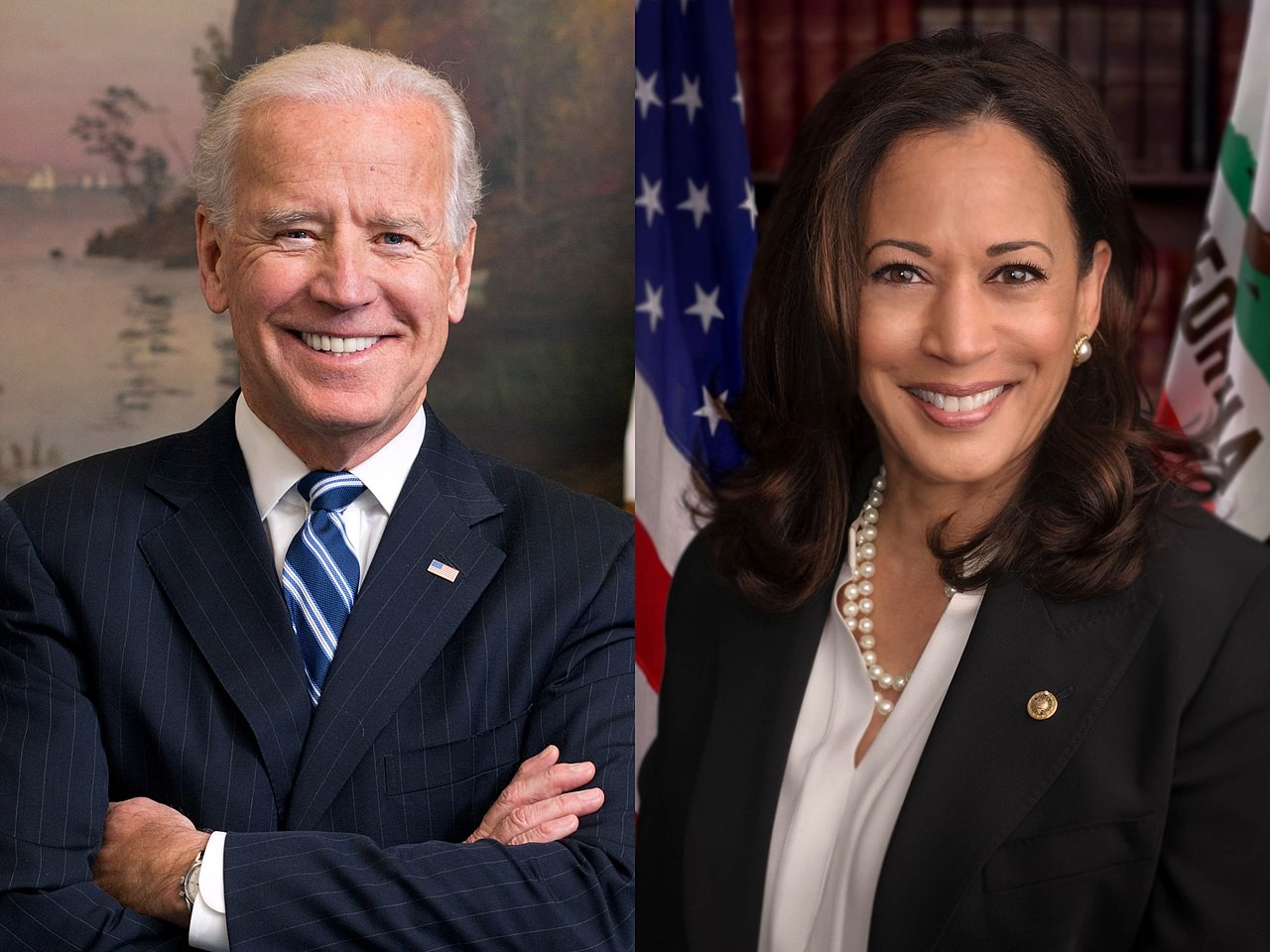

Biden-Harris Administration Approves $130 Million Group Discharge for 7,400 Borrowers from Colorado Locations of CollegeAmerica

The Biden-Harris Administration today announced it will deliver $130 million in automatic relief to 7,400 students who enrolled at Colorado-based locations of CollegeAmerica between Jan. 1, 2006, and July 1, 2020. The U.S. Department of Education (Department) found that CollegeAmerica’s parent company, the Center for Excellence in Higher Education (CEHE), made widespread misrepresentations about the salaries and employment rates of its graduates, the programs it offered, and the terms of a private loan product it offered. The Department used evidence provided by Colorado Attorney General Phil Weiser, who led a multi-year investigation and lawsuit against CEHE and its leadership. Borrowers will receive this relief regardless of whether they have filed a borrower defense to repayment application.

Today’s action is yet another result of the strong partnership between the Department and state attorneys general, whose investigations and lawsuits focused on wrongdoing by predatory schools, have helped deliver billions of dollars in relief to affected student loan borrowers. The Biden-Harris Administration has approved $14.7 billion in relief for 1.1 million borrowers whose colleges took advantage of them or closed abruptly. This includes giving hundreds of thousands of borrowers a fresh start from loans taken out at Corinthian Colleges and ITT Technical Institute. The Department also issued a new, stronger borrower defense regulation that gives borrowers a fairer path to a discharge when their college took advantage of them. Overall, the Biden-Harris Administration has approved more than $116 billion in relief to over 3.4 million borrowers under President Biden’s leadership.

“This announcement means a clean slate for thousands of students hurt by CollegeAmerica’s widespread misconduct,” said the Department’s Federal Student Aid Chief Operating Officer Richard Cordray. “The close partnership between the Department of Education and Attorney General Weiser’s office made this action possible. We will continue to work to deliver targeted student loan relief to borrowers whose schools take advantage of them.”

“I applaud the Department of Education for providing much-deserved relief to the many Coloradans who were mistreated by CollegeAmerica,” said Colorado Attorney General Weiser. “CollegeAmerica knowingly took advantage of students by luring them into high-priced, low-quality programs with promises of high-earning potential and job placement that it knew were not attainable. Protecting borrowers from predatory lending and helping Coloradans navigate through student loan burdens will continue to be a priority for our office.”

Starting in 2012, the Colorado Attorney General investigated the practices of CEHE and its leadership in that state, which culminated in a 2017 bench trial, and a judgment in favor of the state in 2020. The Department had more than 300 trial exhibits, including internal policies, procedures, and emails that CEHE provided to its accreditor, ACCSC. The Colorado Attorney General’s Borrower Defense application, which cited to the district court’s 2020 opinion, helped point the Department to the most relevant evidence. The Department also reviewed testimony given under oath from 40 witnesses during the trial, including experts, former students, and CEHE officials. The Department reached its conclusions based on its independent review of the Colorado evidence, as well as information from other borrower defense applications. The Colorado CollegeAmerica campuses stopped enrolling new students in 2019 and closed by September 2020. CEHE closed all its remaining campuses in August 2021.

Based on that evidentiary review, the Department concluded that CEHE engaged in the following pervasive and widespread misrepresentations over a multi-year period at the Colorado campuses of CollegeAmerica:

From 2006 until 2020, CEHE prominently included in its admission and advertising materials that its graduates would earn high salaries. But the included data was misleadingly based on national averages. In fact, internal CEHE data showed Colorado CollegeAmerica campus graduates on average earned just $25,000 five years out of school, less than the salaries of high school graduates publicized by the school.

From 2009 through 2012, and again in 2015, CollegeAmerica campuses in Colorado advertised inflated and falsified job placement rates of 70 percent, when internal figures showed the actual number was 40 percent. This included counting a business administration graduate working as a produce clerk and a medical specialties graduate working as a waiter as successful placements.

From 2007 through 2017, CEHE falsely told students that its private loan product was “affordable,” when it knew that some years as many as 70 percent of CollegeAmerica borrowers enrolled in the Colorado campuses defaulted. Overall, more than 850 CollegeAmerica students had judgments filed against them by CEHE’s debt collectors.

Starting in 2006 and continuing until 2014, CEHE lied to students of the Colorado CollegeAmerica campuses by telling them that it either offered certain programs or that a given offering would qualify the borrower for employment in a given field. For instance, from 2006 through 2012, CEHE claimed that a medical specialties program would allow students to obtain the certifications to become an X-ray technician, though the school did not even own any X-ray machines.

The Department will begin notifying eligible borrowers in August that they are approved for discharges. Borrowers will see any remaining loan balances zeroed out and credit trade lines deleted. Any payments they made to the Department will be refunded.

The Department invites more states to provide evidence of wrongdoing as Colorado did here to justify relief for students who were harmed. The borrower defense regulations that went into effect on July 1, 2023, include a specific process for states to use to submit group applications. The group application that state agencies and legal assistance organizations can use is available on StudentAid.gov.

Unwavering commitment to relief

The Biden-Harris Administration remains steadfast in its commitment to use all available tools to deliver promised relief to students, borrowers, and their families. Thus far, more than 3.4 million people have been approved for over $116 billion in loan discharges. The changes that the Administration has made include fixes to ensure that borrowers get relief promised by Congress through income-driven repayment programs, Public Service Loan Forgiveness, and discharges for borrowers with a total and permanent disability. This month, the Department also initiated a rulemaking process aimed at opening an alternative path to provide debt further relief to as many borrowers as possible, as quickly as possible.