Mumbai: The Association of Chartered Certified Accountants (ACCA) has released a report titled “G20 public trust in tax”, a pulse check on public trust and people’s views on taxation throughout G20 countries, in partnership with International Federation of Accountants (IFAC) and Chartered Accountants Australia and New Zealand (CA ANZ). It drew on the views of more than 7,600 people across the G20 countries, which in turn account for two-thirds of the world population, 85 per cent of the Gross World Product and 75 per cent of world trade. The survey saw 360 respondents from India.

This report is the first ever in-depth study of people’s views and who they trust on international taxation across the G20 Nations. The results show that people want their governments to cooperate for a more coherent international tax system; they trust professionals, but have developed a deep distrust of politicians when it comes to tax.

“Indians in particular, have a higher level of trust in multinationals and professional accountants in India, in comparison to much of the G20 countries, to create a fair and appropriate tax system,” said Md. Sajid Khan, head of international development at ACCA.

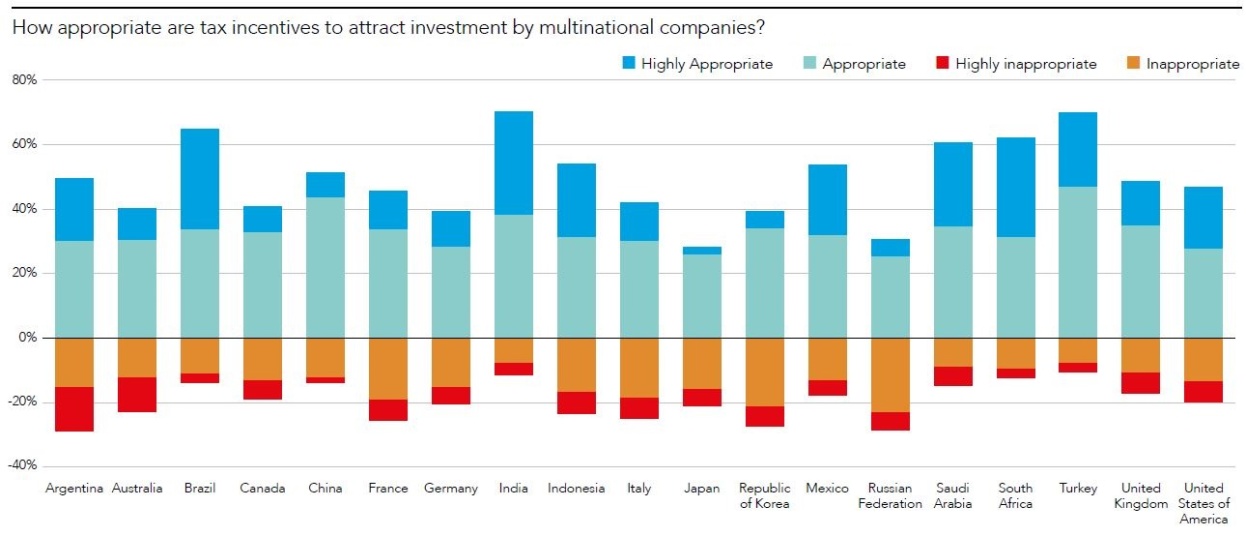

The report reveals that nearly 70 per cent of Indians believe that multinationals are paying reasonable amounts of tax and that it is appropriate to offer tax incentives to attract overseas investment. In contrast, across the G20, only 52 per cent of respondents are likely to have trust in multinationals’ tax arrangements, and just 49 per cent think that tax incentives should be offered.

The view across the G20

“The average citizen of a G20 country is more concerned that their government cooperates with other countries for a more coherent international system, than competes for national interests such as increasing tax revenue or attracting multinational business,” says Chas Roy-Chowdhury, head of tax at ACCA.

“While I wouldn’t support constant tinkering with the tax system by governments of G20 countries—as tax regimes need to be long-term and properly bedded down—it is interesting to see that people are highly in favour of utilising tax systems to achieve broad social and economic objectives,” added Roy-Chowdhury.

“More than three quarters (76%) of respondents are supportive of government tax incentives for green energy projects, 74% for retirement planning and 68% for infrastructure projects.”

There are diverse views on tax minimization throughout G20 countries

“The results of the survey indicated that in English-speaking countries of the G20, there was scepticism around tax minimisation,” said Russell Guthrie, Executive Director – External Affairs at IFAC.

Notes to Editors

G20 public trust in tax: key findings

• 57% of people in G20 countries trust or highly trust professional tax accountants as a source of information about the tax system, professional tax lawyers (49%), and non-government organizations (35%).

• People in G20 countries have become deeply distrustful of politicians when it comes to information about the tax system, with 67% either distrusting or highly distrusting politicians.

• The public trust deficit extends to media (41% distrust or highly distrust), and business leaders (38%).

• People want governments to put tax cooperation ahead of tax competition – 73% of people in G20 countries think it is important or very important for governments to cooperate with each other on tax policy to create a more coherent international tax system; and people are over 3.5x more likely to favour cooperation over competition.

• 73% people in G20 countries see paying taxes as mainly a matter of laws and regulation, and people are more than 2x more likely to see paying taxes as about laws and regulations, than morals and fairness.

• While views diverge considerably across G20 countries, more people overall tend to believe high income earners, and local and multinational companies are paying a reasonable amount of tax in their country than think average or low income earners are paying enough.

• There are also diverse views on tax minimization throughout G20 countries, although perhaps surprisingly 15% more people overall appear to view tax minimization as appropriate or highly appropriate for high income earners, and local and multinational companies than for average or low income earners.

• 58% of people in G20 countries believe the work of professional accountants is contributing to more efficient tax systems; 56% more effective tax systems; 49% more fair tax systems.